|

View: 5535|Reply: 36

|

[Dunia]

Salah Rosmah Pasaran Saham China hilang USD 3,000 billion?

[Copy link]

|

|

|

China Stocks Lose US$3 Trillion, And Counting – Ready For A Huge Burst?

JUL072015

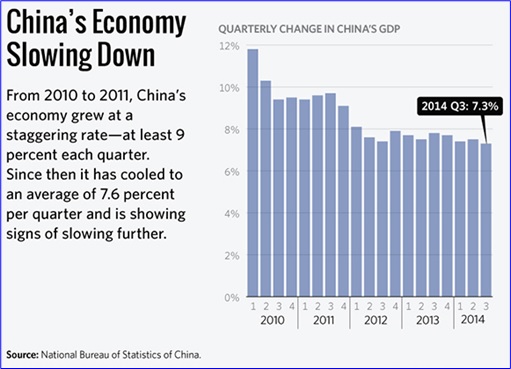

Is the party over for China? Nobody knows for sure. But it doesn’t seem to be doing as well as it used to be. It’s double-digit growth was long gone. The last time the world’s second-largest economy saw double-digit growth rates was in 2010 when it grew at a rate of 10.6%. Thereafter, it was 9.5% (2011), 7.8% (2012), 7.7% (2013) and 7.4% (2014).

There was brouhaha about China returning to its double-digit growth last year, but it didn’t happen. Despite single-digit growth for the last 3-years, the world didn’t end, did it? Nope, the globe is still spinning. China’s slowing economy doesn’t crash the global economy. But that’s because its property and stock markets are still holding on, but not for long.

The country’s job market is slowing down. It’s getting harder and harder to find jobs, even if the graduates received their foreign education. So much so that a mainland university, Kunming University, has launched a “talent shop” to sell its graduates to prospective employers online on sites such as Alibaba’s Taobao.

But the latest and biggest problem is the mainland’s stock market. China’s stock market has crashed 30% since its June 12 peak, ending an 8-month-long bull run. It got so bad that a whopping 700 companies have issued requests to suspend trading. The fact that the number represents 25% of firms listed speaks volumes about the severity of the problem.

The 702 firms, out of roughly 2,808 firms listed on the main Shanghai and Shenzhen bourses, said the trading halts were due to restructuring, planned share placements or the pending release of a “significant matter”. Of course, any veteran traders know those were merely excuses. They are halting trading to prevent further falls in their share prices, that’s all.

Since its June 12 peak, the two indices combined lost roughly US$3 trillion (£1.92 trillion; RM11.45 trillion), with the index now up just 36% for the year, after being up 122% less than a month ago. Here’s what raises billions of eyebrows – so far, Beijing fails to stop the bleeding, despite numerous medications.

IPO, or initial public offerings, have been suspended to avoid new listings diverting funds for the secondary market. The move came hours after 21 major Chinese brokerage firms pledged no less than 120 billion yuan (US$19.3 billion) to form a stock market rescue fund. The ruling Communist Party has urged investors to stay calm. Still, panic selling continues.

There’s little doubt that the bubble has burst, at least to the small-cap/tech stocks. The 120 billion yuan may look like a lot of money, but that’s a drop in the ocean considering the daily turnover of over 2 trillion yuan. Any Chinese analyst or trader can tell you that the 120 billion yuan won’t last for an hour in such bearish market.

After the closing bell today (Tuesday), Shanghai bourse loses another 47.72 points or 1.26%, but not before it lost about 190 points in the morning. Here’s the tricky part. Should Beijing continue to intervene in a bigger wave? If it does, it may just make things worse because it would create a perception of desperation, and in the process invites bigger panic selling.

With US$3 trillion lost in market capitalization, which is more than 10-times the size of Greece’s economy, the Chinese government has every reason to be concerned. Beijing has also lowered interest rates 4 times since last Nov, relaxed restrictions on buying stocks with borrowed money and even trumpeted patriotic reasons for the public to hold on to their shares.

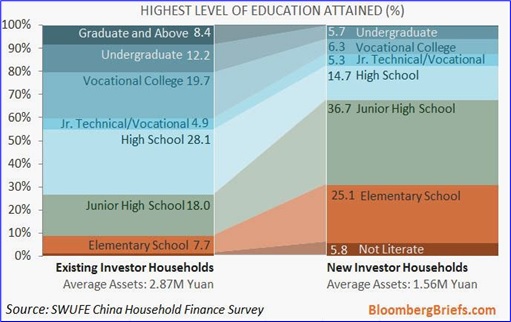

The root to the sudden crashes could be a simple one. According to Financial Times, more than 12 million new accounts were opened on the stock exchange in May alone. If that was not bad enough, consider the mind-boggling fact that two-thirds (67.6%) of households who opened accounts in the first quarter of 2015 didn’t even finish high school.

Obviously the bull run was due to relatively inexperienced retail investors. Does this sound like a casino or “pump and dump” scams? Absolutely. From the U.S. stock markets to the Malaysia stock exchange, such pattern happened before, and it’s happening now in China. So-called experts “stir-frying” stocks while the ignorant investors get screwed.

If you had experienced the Malaysia 1993 Super Bull Run, the same scenario happens in China. The stock market fever has even spread to China’s universities. So, instead of studying, 31% of college students are buying and selling stocks. And three quarters of them got their funding from their parents, who also involved in the stocks.

It doesn’t matter if China’s economy and exports are shrinking, because the Chinese people were making money in the stock market, until now. The rally in the stock market brought along a record margin debt of US$358 billion. During the peak of last year’s rally, the P/E ratio for Shenzhen Stock Exchange went as high as 146.57 times earnings.

Here’s the scariest part. The Chinese government has zero experience in handling a real full-blown bubble crash. This is the first time in 5,000 years of China civilization that the Chinese people has experienced a bull run for such a long time. Naturally, when it crashes, trillions of dollars would be wiped out. And we haven’t talk about its effect on property market (*grin*).

http://www.financetwitter.com/2015/07/china-stocks-losses-us3-trillion-and-counting-ready-for-a-huge-burst.html

salah ahkak rosmah?  |

|

|

|

|

|

|

|

|

|

|

|

incoming world wide recession?  |

|

|

|

|

|

|

|

|

|

|

|

Pasar Saham China Terjun Bebas, 700 Broker Berhenti Jualan

Angga Aliya - detikfinance

Rabu, 08/07/2015 10:58 WIB

Foto: Reuters

Shanghai -Pasar saham China terjun bebas, pagi tadi langsung anjlok 8% setelah pembukaan perdagangan. Sekitar 700 perusahaan sekuritas alias broker berhenti jualan.

Sebab, rata-rata terjadi koreksi hingga 10% di saham-saham emiten China sebelum akhirnya terkena autoreject. Beberapa broker ada yang memutuskan untuk sengaja menghentikan perdagangan daripada harus babak belur gara-gara koreksi tajam tersebut

Sebagian dari para broker ini mengumumkan rencana tidak berdagang sebelum pasar dibuka pagi tadi. Mereka menunggu pemerintah turun tangan untuk mengatasi anjloknya pasar saham tersebut.

"Seharusnya pelaku pasar percaya diri dan jangan panik supaya risiko di Pasar Modal China bisa dikontrol dan sentimen negatif bisa dikurangi," kata salah satu analis China dimuat oleh media lokal dan dikutip CNN, Rabu (8/7/2015).

Sejak awal Juni, Indeks Komposit Shanghai sudah anjlok lebih dari 32%. Sementara Indeks Komposit Shenzen jatuh lebih parah lagi, sampai 41% dalam waktu yang sama.

Dua indeks acuan itu sudah melonjak tinggi sejak awal tahun ini, masing-masing hingga sebesar 70% dan 100%.

http://finance.detik.com/read/20 ... ker-berhenti-jualan

|

|

|

|

|

|

|

|

|

|

|

|

Minyak Jatuh Cecah AS$56 Setong

Wednesday, 08 July 2015 Written By Moderator E-mailPrintPDF

0 Komen

inShare

LONDON 9 Julai - Minyak jatuh kepada AS$56 setong hari ini dalam dagangan tipis berikutan pasaran saham China merudum dan kemelut hutang Greece membangkitkan kebimbangan mengenai pertumbuhan sederhana yang boleh menjejaskan permintaan minyak.

Minyak mentah Brent pula jatuh 66 cents kepada AS$56.19 setong selepas mencecah AS$55.10 pada sesi pagi, paras terendah sejak 6 April manakala kontrak AS, WTI jatuh 57 cents kepada AS$51.76.

Antara faktor menurunkan harga minyak adalah penurunan pasaran ekuiti China yang menjejaskan permintaan minyak, kemungkinan penyelesaian perjanjian nuklear dengan Iran dan krisis Greece. |

|

|

|

|

|

|

|

|

|

|

|

|

Another recession is coming. Sepatutnya 2018 tp kali ni awal. So be prepared for it. Jgn beli kereta baru, jgn beli rumah baru, jgn joli. Practise financial prudence... |

|

|

|

|

|

|

|

|

|

|

|

|

Ramailah ummah jinjang yg bunuh diri lepas ni |

|

|

|

|

|

|

|

|

|

|

|

takat 1-2 juta mati pun takdak hal

|

|

|

|

|

|

|

|

|

|

|

|

Kita dimalaysia ada masalah politik, ada masalah ekonomi, ada masalah perkauman.

Lepas raya ni..Malaysia akan bengrap?..ramai lah yg akan menganggur... |

|

|

|

|

|

|

|

|

|

|

|

xdptla nak beli kete proton baru tahun depan dgr citer cantik cantik

|

|

|

|

|

|

|

|

|

|

|

|

RABU, 8 JULAI 2015 @ 6:19 PM Ringgit tinggi sedikit berbanding dolar AS KUALA LUMPUR: Ringgit ditutup tinggi sedikit berbanding dolar AS dan hampir tidak bergerak sepanjang sesi dagangan, kata peniaga. Pada jam 5 petang, ringgit disebut pada 3.8050/8080 daripada 3.8060/8080 pada Selasa. Peniaga berkata, bank pusat campur tangan untuk memastikan unit tempatan kukuh, bagaimanapun ringgit dijangka terus lemah susulan jualan ekuiti dan bon Malaysia yang berterusan. Sementara itu, harga minyak mentah West Texas Intermediate (WTI) turut dijangka terus merosot berdasarkan momentum jualan berikutan kebimbangan yang memuncak, susulan keyakinan kemajuan dalam perjanjian program nuklear Iran. "Tekanan penurunan dalam WTI turut memberi inspirasi kepada momentum jualan dalam mata wang dengan ekonomi yang berkaitan dengan eksport minyak mentah, seperti Dolar Kanada, Peso Mexico, Ringgit Malaysia dan Ruble Rusia," kata seorang lagi peniaga. Unit tempatan diniagakan rendah berbanding sekumpulan mata wang kecuali pound British. Ia jatuh berbanding dolar Singapura kepada 2.8063/8087 daripada 2.8058/8074 pada Selasa, susut berbanding yen kepada 3.1276/1313 daripada 3.1026/1048 dan turun berbanding euro kepada 4.2015/2056 daripada 4.1737/1762 semalam. Ringgit mengukuh berbanding pound sterling kepada 5.8616/8681 daripada 5.9020/9062 pada Selasa. - BERNAMA DISYORKAN

Selanjutnya di : http://www.bharian.com.my/node/66664 |

|

|

|

|

|

|

|

|

|

|

|

Bell posted on 9-7-2015 07:06 AM

Another recession is coming. Sepatutnya 2018 tp kali ni awal. So be prepared for it. Jgn beli kereta ...

Kan? Agree with u

@Acong apa bisnes bagus masa recession |

|

|

|

|

|

|

|

|

|

|

|

ekonomi china ada kaitan dgn kita kaa? minyak sawit pun depa import dgn indon.....

kita cuma eksport durian beku kat sana je

recession? bisnes hobi bodo..... masa recession, org beralih bela ikan (pets)....

kan masa 1999 tu femes dgn ikan flower horn....

|

|

|

|

|

|

|

|

|

|

|

|

goreng pisang cheese

|

|

|

|

|

|

|

|

|

|

|

|

semua ini boleh diselesaikan dgn jayanya kalau PR yg terdiri dari bijak pandai PKR, DAP dan PAS yg memerintah China atau dunia.... ...itu lah yg difikir oleh penjilat jilat DAP semelayu... ...itu lah yg difikir oleh penjilat jilat DAP semelayu...

|

|

|

|

|

|

|

|

|

|

|

|

this is not the time buat bisnes dgn duit pinjaman...nak bisnes guna duit sendiri...meniaga air..

|

|

|

|

|

|

|

|

|

|

|

|

Mahal...org dah tak ada duit...goreng pisang cheese bakal tak laku.

time kemelesetan ekonomi...org nak yg murah...janji kenyang..

|

|

|

|

|

|

|

|

|

|

|

|

wowwww...saya misti pelihh..

|

|

|

|

|

|

|

|

|

|

|

|

tadi buka puasa jilat jubur umno ke |

|

|

|

|

|

|

|

|

|

|

|

aku mohon sesiapa yang nak meniaga air ni tak kisahlah air cincau ke, temikai ke, mata kucing ketolong la guna air masak or air tapis/suling

jangan la direct dari air paip belakang rumah

kesian pembeli sakit perut cirit birit

|

|

|

|

|

|

|

|

|

|

| |

|