|

|

[Dunia]

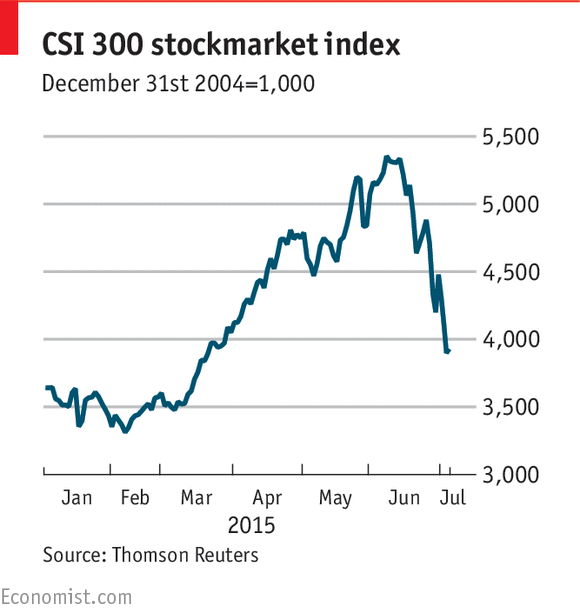

Salah Rosmah Pasaran Saham China hilang USD 3,000 billion?

[Copy link]

|

|

|

jual air ketum

|

|

|

|

|

|

|

|

|

|

|

|

Edited by rosmahisham at 9-7-2015 08:48 AM

kukulangau replied at 9-7-2015 08:28 AM

aku mohon sesiapa yang nak meniaga air ni tak kisahlah air cincau ke, temikai ke, mata kucing keto ...

nk tambah lg sikit..biar la manis sikit..ni tawar hebeh..beli kat bazar ramadhan.baik aku buat sendiri air sunquick kat rumah.igt teringin la minum air mata kuching@ longan, katira dsb.tp hampeh igt nk sng tp sudahnya aku jgk yg kena merepair tambah gula lg. |

|

|

|

|

|

|

|

|

|

|

|

dengar2 kerajaan china gigih beli saham2 kompeni besar ni untuk mengelakkan kejatuhan berterusan, dengan menggunakan dana dari pension fund dan dana amanah awam yang lain...

interest rate kat china pon dah diturunkan, bagi menggalakkan pelacur (terasa @scorpionkiki profesion dihina) eh pelabur pump duit dalam pasaran saham...

bayangkan kalau umno yang buat camtu.. mau tertekan para macai sekalian... |

|

|

|

|

|

|

|

|

|

|

|

malaysia tak ramai yg terbabit masalah perkauman.

cuma parti2 dan pertubuhan2 ketuatnan je yg rasis takmenentu hala.

kalu tak caya bleh tanya @d'zeck

|

|

|

|

|

|

|

|

|

|

|

|

rosmahisham replied at 9-7-2015 08:46 AM

nk tambah lg sikit..biar la manis sikit..ni tawar hebeh..beli kat bazar ramadhan.baik aku buat s ...

Nak tambah juga. Ada peniaga tu jual air boh gula banyak sangat. Sampai hilang flavor air tu, minum air gula je la waktu berbuka. Mungkin sebab tak boleh rasa so peniaga pun tak sure macam mana nak sukat gula. Haih. |

|

|

|

|

|

|

|

|

|

|

|

A red flagJul 7th 2015, 9:36 [size=1.2]BY S.R. | SHANGHAI

[size=1.5]CHINA is certainly not the first country to try to prop up a falling stockmarket. The central banks of America, Europe and Japan have all shown form in buying shares after crashes and cutting interest rates to cheer up bloodied investors. But the circumstances and the manner of China’s intervention of the past ten days make it an outlier, worryingly so.

[size=1.5]The trigger in China’s case is perplexing. Yes, the stockmarket is down a third over the past month, but that has simply taken it back to March levels; it is still up 80% over the last year. Growth, though slowing, has stabilised recently. Other asset markets are performing well. Property, long in the doldrums, is turning up. Money-market rates are low and steady, suggesting calm in the banking sector. The anticipated correction of over-valued stocks hardly seems cause for much anguish. [size=1.5]Yet China’s intervention has screamed of panic. Had the central bank stopped at cutting interest rates—justifiable support for the economy when inflation is so low—that would have been reasonable. Instead, there has been a spectacle of ever-more drastic actions to save the market. Regulators capped short selling. Pension funds pledged to buy more stocks. The government suspended initial public offerings, limiting the supply of shares to drive up the prices of those already listed. Brokers created a fund to buy shares, backed by central-bank cash. All the while, state media played cheerleader. Far from saving the market from drowning, the succession of life buoys only pushed it further under water. The CSI 300, an index of China’s biggest-listed companies, fell almost 10% over seven trading days after the rate cut. ChiNext, an index of high-growth companies that is often described as China's Nasdaq, fell by 25%. [size=1.5]Theories have flourished about why the government has waded in so heavily. The apparent desperation is, some believe, a sign that officials see a looming economic collapse, and are trying to staunch the wound before social upheaval ensues. That story is intriguing, but it is not the most likely. [size=1.5]Lost in all the drama about the stockmarket is that it still plays a surprisingly small role in China. The free-float value of Chinese markets—the amount available for trading—is just about a third of GDP, compared with more than 100% in developed economies. Less than 15% of household financial assets are invested in the stockmarket: which is why soaring shares did little to boost consumption and crashing prices will do little to hurt it. Many stocks were bought on debt, and the unwinding of these loans helps explain why the government has been unable to stop the rout. But this financing is not a systemic risk; it is just about 1.5% of total assets in the banking system.  [size=1.2] [size=1.2]

Chinese growth is losing altitude. Will it be a soft or hard landing?

[size=1.5]If economic stability is not in peril, why then the panic? The most compelling explanation is politics. The government has staked much credibility and prestige on the stockmarket. When the going was still good, the official press was chock-a-block with articles about how the rally reflected the economic reforms that Xi Jinping, China’s top leader, was set to push. Li Keqiang, the premier, said repeatedly that he wanted equity markets to provide a bigger share of corporate financing—comments, from punters' perspective, not unlike waving a red cape in front of a bull. The sudden end to the rally is the first major dent in the public standing of the Xi-Li team. The botched attempts to stabilise the market only make them look weaker, giving succour to their critics. [size=1.5]But the biggest concern about the panicked policy response is what it says about the government's agenda. The economic hopes invested in Messrs Xi and Li stemmed from their pledge in late 2013 to let market forces play a “decisive role” in allocating resources. The actions of the past ten days have made abundantly clear that it is still the other way around: the Chinese government wants a decisive role in markets. [size=1.5]The failure of share prices to do their bidding is, in that respect, welcome. It shows that the Communist Party, powerful though it may be, cannot indefinitely bend markets to its will. Chinese leaders should heed that lesson and get on with the challenges of liberalising their economy. A relapse towards statism will not just set China back. It also will not work.

|

|

|

|

|

|

|

|

|

|

|

|

|

aritu kat bazar ada gerai jual mi mihun kuewtiaw grg lambak tu..panjang beratur..aku pon tpikir gak mesti sdp.sekali beli rupanye murah.pty la berderet2 org.blk mkn langsung x de rasa sdhnye aku repair lg tambah cili sos tiram,garam ..baru blh mkn.dlm hati..mmg time skrg ni org x kisah eh x sdp pon jnji murah.rega 1rm ke 1.50 rm mcm tu la.x igt dh. |

|

|

|

|

|

|

|

|

|

|

|

ko pi cerita dgn org lain lah..dgn aku ko tak payah cerita pasal perkauman ni...aku lagi tahu dari ko...

|

|

|

|

|

|

|

|

|

|

|

|

Mary_jane replied at 9-7-2015 08:53 AM

Nak tambah juga. Ada peniaga tu jual air boh gula banyak sangat. Sampai hilang flavor air tu, minu ...

uols beli fruit juice ke..klu air buah mmg confirm kurang rasanye.dah tu tembikai nye sebiji @1/2 biji je , tambah air n ais sampai penuh balang, tambah gula..tu yg rasa lari..harapkan bau buah je la.. |

|

|

|

|

|

|

|

|

|

|

|

siapa makan lada dia lah penjilat kepedasan...

|

|

|

|

|

|

|

|

|

|

|

|

semalam beli sup perut....... masa beli wangi je...... tang masa nak makan, sup tu manis....... last2 tak habis.... gila pe letak gula dlm sup?  |

|

|

|

|

|

|

|

|

|

|

|

Peniaga tertumpah gula kot kat periuk sup perut tu.

|

|

|

|

|

|

|

|

|

|

|

|

salah 1MDB?  |

|

|

|

|

|

|

|

|

|

| |

|